Tax Return For Dependent Child 2024

Tax Return For Dependent Child 2024. However, only one divorced parent is allowed to. The maximum tax credit available per kid is $2,000 for each child under 17 on dec.

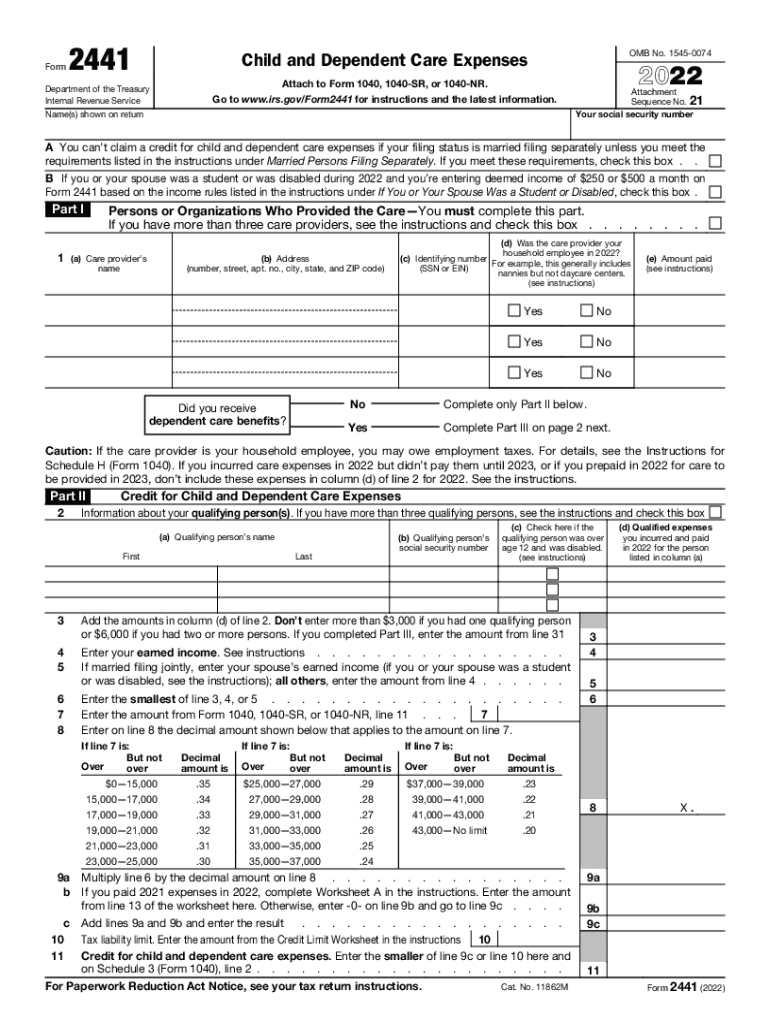

Child and dependent care tax credit (cdctc) you can claim this credit if you have earned income and if you’re paying someone else to care for a dependent. Only a portion is refundable this year, up to.

Dependent Children Who Earn More Than $13,850 In Tax Year 2023 ($14,600 In 2024) Must File A Personal Income Tax Return.

A tax dependent is a qualifying child or relative who can be claimed on a tax return.

The Original Dependent Exemption Amount Worth $4,050 Is No Longer Available.

In 2024, the federal income tax.

If You're Still Waiting To Get Your Child Tax Credit Refund And It's Been More Than 21 Days Since You Filed With The Irs, It's Time To Track Your Money Down.

Images References :

/Form-w4-e54ebb209cbc48b48541a54b07e2d5c2.jpg) Source: worksheets.decoomo.com

Source: worksheets.decoomo.com

10++ Regular Withholding Allowances Worksheet A Worksheets Decoomo, Child and dependent care tax credit (cdctc) you can claim this credit if you have earned income and if you’re paying someone else to care for a dependent. However, only one divorced parent is allowed to.

Source: gardnerquadsquad.com

Source: gardnerquadsquad.com

Can I Claim My Child As A Dependent On My Tax Return? Gardner Quad Squad, Child and dependent care tax credit (cdctc) you can claim this credit if you have earned income and if you’re paying someone else to care for a dependent. The child tax credit for the tax year 2023—meaning for the tax return you’ll file in early 2024—is $2,000 per qualifying child.

Source: printableformsfree.com

Source: printableformsfree.com

State Withholding Tax Form 2023 Printable Forms Free Online, A dependent child with earned income more than $13,850 (the 2023 standard deduction for a single individual) is required to a file a return. You may file your income tax return without claiming your daughter as a dependent.

Source: healthplusplan.ca

Source: healthplusplan.ca

Who Qualifies as a Dependant? Health Plus, To claim a dependent for tax credits or deductions, the dependent must meet specific requirements. This is because the tax on this second $1,250 can be up to 10% on a parent’s return but might qualify for the preferential 0% tax rate for qualified dividends.

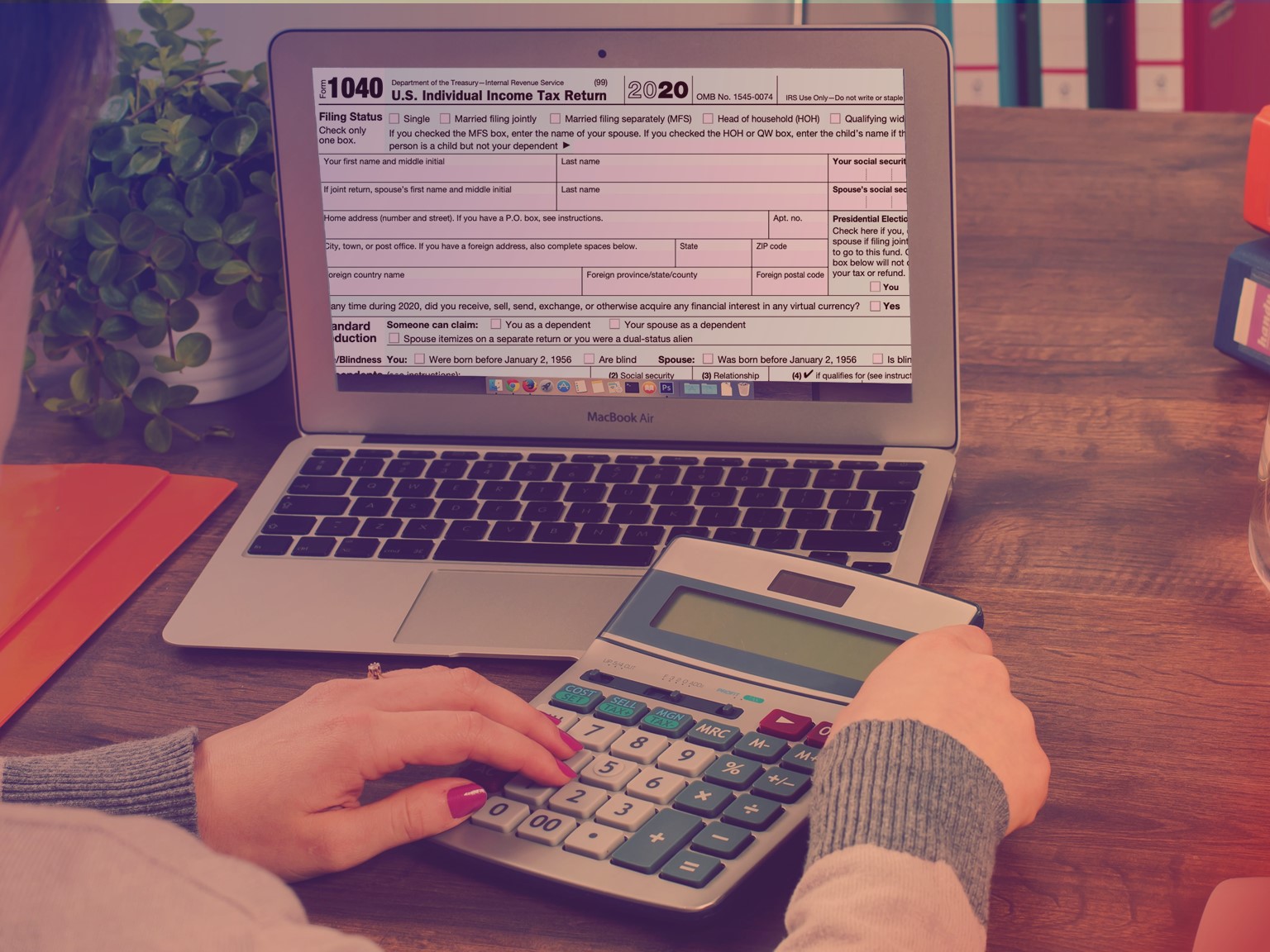

Source: www.dreamstime.com

Source: www.dreamstime.com

Child and Dependent Care Tax Credit Form. Editorial Image Image of, With the background of numerous news about the child tax credit this year, where 16 states also offer a credit and congress is working on an extension of it, we will. However, only one divorced parent is allowed to.

Source: 2022jwg.blogspot.com

Source: 2022jwg.blogspot.com

Child And Dependent Care Credit 2022 2022 JWG, Only a portion is refundable this year, up to. What else would change with the.

Source: refundtalk.com

Source: refundtalk.com

2022 Education Tax Credits ⋆ Where's my Refund? Tax News & Information, To claim the child tax credit, a parent must have a qualifying dependent child younger than 17 at the end of 2023. However, other tax benefits, such as the child tax credit, are still available to claim.

Source: sdgaccountant.com

Source: sdgaccountant.com

How to Claim a Dependent on Your Tax Return? SDG Accountants, The government uses these brackets to determine how much tax you owe, based on how much you earn and your slice (s) of pie. A tax dependent is a qualifying child or relative who can be claimed on a tax return.

Source: haugenlawgroup.com

Source: haugenlawgroup.com

Claiming Advance Child Tax Care Credits for Tax Year 2021 Haugen Law, However, other tax benefits, such as the child tax credit, are still available to claim. Here is everything taxpayers need to know about claiming the earned income tax credit and the child tax credit for the 2024.

Source: www.signnow.com

Source: www.signnow.com

Child and Dependent Care Credit 20222024 Form Fill Out and Sign, If you're still waiting to get your child tax credit refund and it's been more than 21 days since you filed with the irs, it's time to track your money down. The maximum amount for the 2023 and 2024 tax years is $2,000 for each qualifying child.

Answer Questions To See If You Can Claim Someone As A.

Your average tax rate is.

Unlike The Ctc, Which You Can Only Claim If.

Interpretation services for other languages.